You’re in your 60s now, and if you’re intentional, it’s going to be an amazing decade for you. Now’s the time to reinvent your lifestyle and make decisions about what the next 20-30 years are going to look like. Life may still be a bit hectic. You may be looking forward to retirement. Your adult children may have moved back in while they ground themselves. You may be caring for aging parents. You may want to travel or spend time with all the grandkids. No matter what your goals, you need healthy habits and practices to get you there.

Just remember that no matter what your lifestyle looked like before, it doesn’t have to stay that way. You can change your lifestyle to reflect your new goals in life. It just takes time and determination. How you age – whether well or poorly – is almost entirely up to you and the habits you cultivate. Now, let’s talk about 10 helpful and healthy practices you can cultivate in your 60s that will lead to better physical health, mental health, and aging well.

Kick Bad Habits

We all have bad habits, but it’s never too late to kick them to the curb. Some of the most common medical concerns – obesity, diabetes, and some forms of cancer – are directly related to lifestyle choices. So, take steps to quit the habits that may be hurting your body.

For example, quit smoking, lose excess weight, drink alcohol in moderation, increase your activity levels, and reduce your sugar intake. In addition to these, you may have a few more bad habits you’d like to leave behind. Write a list of your new goals and make a realistic and actionable plan for how to accomplish them.

Exercise Regularly

As you grow older, focus on strength training, aerobic exercise, and flexibility. Building up your muscles will help you maintain strength, increase bone density, and boost energy levels. If you use weights or resistance bands, start with lighter weights and work your way up. Weight-bearing exercise will help to increase bone density and keep you active longer into your later years. Adding in aerobic exercise – anything that gets your heart rate up – will increase your heart health and help with weight management. And finally, flexibility works in tandem with your exercise regime and is vital to developing strong muscles and bones.

To begin, find an activity you like and stick with it. Invite a friend to join you. Yoga, swimming, golf, and walking are all great ways to stay strong and active. Experts say to get at least 30 minutes of physical activity on most days of the week. If needed, you can break the time up – two 15-minute sessions or three 10-minute sessions. Whatever works best with your schedule and lifestyle.

Eat Healthy & Hydrate Often

Of course, we all know that what we put in our bodies has a huge impact on how well our bodies function. So, consider adding more fruits and vegetables, fiber-rich whole grains, lean meats and proteins (e.g. chicken, fish, legumes, nuts, and seeds, and good fats (e.g. avocado, cheese, dark chocolate, whole eggs). Then, as much as you can, avoid eating too many sugary and processed foods.

As for hydration, did you know that as we age, we begin to lose our sense of thirst? That’s why so many older people suffer from undetected dehydration. Be intentional about drinking water, even if you think you don’t need it. The water will hydrate you, increase your metabolic rate, and keep you from feeling as fatigued after exercise.

Get Regular Check-ups, Screenings, and Diagnostic Checks

While regular check-ups, preventative screenings, and diagnostic tests may not sound like much fun, wouldn’t you rather know if there’s an issue so you can take steps to correct it? Visit with your doctor and discuss which screenings they recommend to keep your body healthy and strong.

And don’t be afraid to ask questions – research shows that patients who don’t ask questions or don’t understand their medical condition or prescriptions are at increased risk for complications. So, make sure you fully understand what’s going on with your health.

Pay Attention to Your Bone Density

Our bones are incredibly important to overall health. Bone mass builds rapidly until the age of about 25, and then, without proper care, our bones begin to grow weaker over time. This is one reason why older people are more likely to develop osteoporosis or to fall and break or fracture bones. In fact, according to the National Osteoporosis Foundation, 1 in 2 women and 1 in 4 men will suffer from a fracture due to osteoporosis.

But it’s not too late. You can build up your bones even now. Make sure to get enough calcium and vitamin D but also exercise. Both strength training and weight bearing, like jumping or marching, can help to improve bone density and decrease the risk of osteoporosis.

Keep Your Brain Healthy

You may be approaching retirement and looking forward to taking it easy. Enjoy your time – you’ve earned it. Just remember to keep your brain supplied with new challenges. As we age, our brains produce less serotonin (mood), acetylcholine (memory, learning, and concentration), and dopamine (movement, motivation, and learning). This means that we need to keep the brain active to keep it healthy. Don’t just sit on the couch, catching up on the last 30 years of TV shows. Instead, keep your brain healthy by taking courses, learning new things, or adding to your skillset.

Cultivate a Positive Attitude

In a culture that glorifies youth, it isn’t easy to accept aging. But time marches on for us all, and to age well, it’s best to accept it and make the most of it. In fact, according to research, you can add up to 7.5 years to your life just by cultivating a positive attitude about aging. Additionally, adults with a positive attitude toward aging are less likely to develop dementia. Adults who carry a gene that poses the strongest risk for dementia are 50% less likely to develop dementia. That’s huge! It goes to show the power of perception and positivity to our bodies and minds.

Don’t Waste Your Time

Whether or not you’ve hit retirement yet, be intentional with your time. But especially after retirement, many of us are more likely to become sedentary. In fact, the average retired person spends over 4 hours a day watching TV. That’s time that might be better spent doing things that are healthy for your brain and body. Exercise, socialize, volunteer, cook new things, travel, explore your creativity, or all of the above. Those things that you said you’d do once you had time – do them! Seek meaningful activities and relationships. You won’t regret it.

Maintain a Social Life

We all need relationships. Interacting with those we like boosts our overall health because they help us manage our emotions, reduce our stress, and hold us accountable for maintaining good habits. Perhaps you feel that you have less energy now that you’re a little older, but still, take time to be with others. But make sure that those you spend time with actually add value to your life. If there are people in your life who just drain you, limit your interactions with them and focus on the relationships that bring joy. For your own well-being, you may need to forgive those who have hurt you in the past, but that doesn’t mean they have to be a part of your normal social circle.

Get Your Affairs in Order Now

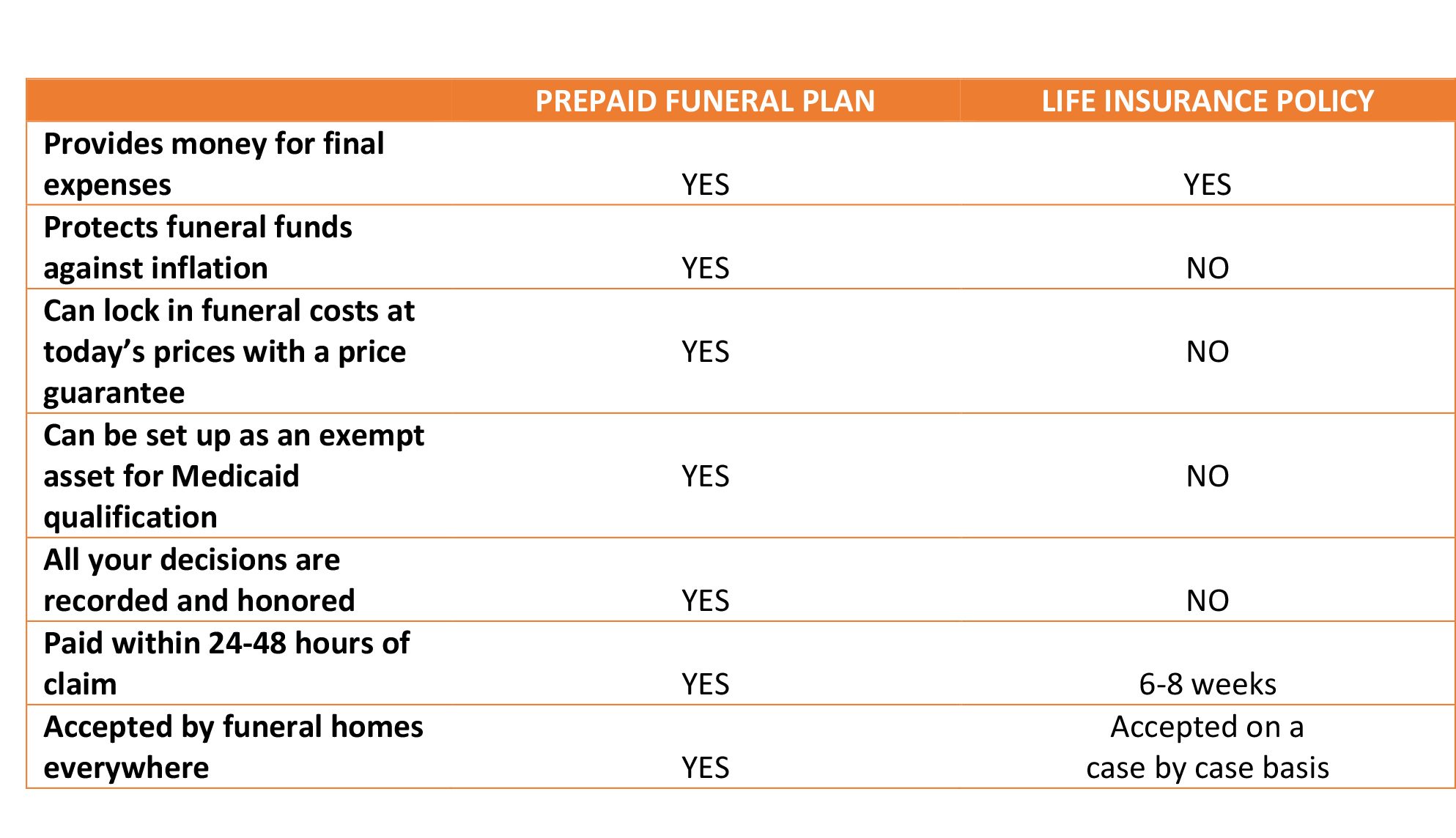

Getting your affairs in order can seem like a daunting task. Maybe you’ve considered organizing all the necessary documents and making all the right calls, but you just aren’t quite sure where to begin. Now is a great time to start. Have you written a legal will so your family knows how you would like to disburse your assets? Have you considered preplanning your funeral, so you can save money and provide your loved ones with a plan? Have you talked to your family or doctor about advance care directives, so they know what kind of medical care you want? All of these are important questions to answer and best done when you are still healthy. Now is a great time to start putting your affairs in order so that you can live with greater peace of mind for years to come.