It’s not uncommon for families to expect to pay for a funeral with life insurance benefits.

Sounds like a simple plan, doesn’t it?

The truth is, there can be many unexpected complications with life insurance policies. Some are no longer valid because no one has paid on them in years, and they have now lapsed. Some have beneficiaries named who are no longer living, which means delays and complications with getting your claim paid. The policy may have a lien on it. Or, the date of death or cause of death could limit the death benefit. Listing an ex-spouse or a minor as beneficiary is also a very common issue. In some states, an ex-spouse listed as a beneficiary will receive nothing unless the divorce decree specifically states that they should. More delays and complications. Any of these “red flags” could prevent you from using your policy for funeral expenses. Even if your policy is problem free, it may take 6 to 8 weeks to receive payment.

Additionally, have you carefully considered the amount of your life insurance policy? Aside from funeral expenses, what else do you want your loved ones to be able to pay for? Is your life insurance beneficiary a co-signer on your credit card bills, and therefore, liable to pay them? Would you want to pay off the mortgage on your home so your surviving spouse can stay there? Or, pay off vehicles or other large items? If your family members rely on your income, will they have enough to cover basic expenses until your income can be replaced? If you incur high medical bills before you pass away, they will be paid for by your estate (assets). Is your insurance policy amount enough to fill the potential loss in your estate’s worth? If you have not considered these secondary expenses, your family may have a hard time covering all the potential costs.

So, a simple plan isn’t so simple anymore.

Here are a few solutions that may help avoid complications with life insurance at the time of death:

Review Your Policies.

If you plan to use life insurance benefits to cover your funeral, check the policy and make sure it is still valid. If you have any questions, contact an elder law attorney. They will help identify any “red flags” in your policies and assist you in correcting them. Or, if you are in the midst of planning a funeral for a lost loved one, you can direct your questions to the funeral home. Please contact your life insurance company for specific questions about your policy.

Make Sure the Policy is Assignable.

When you review your policy, make sure it is “assignable.” You must be able to assign the benefits to go to a third party who will file the claim for you (the funeral home, or an assignment company). The type of policy you signed up for and the life insurance company determine whether a policy is assignable. Funeral homes generally accept a life insurance policy in lieu of payment for a funeral, though it’s best not to assume that they will. Remember, if they do accept a policy as payment, it must be assignable. Retirement benefits and 401(k) benefits are not assignable. If the policy is not assignable, families will be unable to use life insurance to cover funeral costs. This is in large part because insurance companies can take at least 6 to 8 weeks to process a claim. Typically, this is long after the funeral has taken place.

Use an Advance Funding Company.

Some funeral homes partner with advance funding companies (also called an assignment company). Similar to a tax return advance you might get from your tax preparer, advance funding is an advance on your life insurance policy benefits. In short, an assignment company contacts the insurance company and verifies that the policy has not lapsed and has no other issues. Funds are advanced within 24-48 hours once the verification process is complete. The best part is, your claim is filed for you, and any funds in excess of funeral expenses can be advanced right to you. The assignment company will deduct a small fee to cover administrative costs.

If you are interested in finding out more about assignment companies, one reputable assignment service company is CLAIMCHECK. Take a few moments to look at the website. Think about whether an assignment company is an option you’d like to pursue. If it is, contact the funeral homes in your area to find out if they partner with an assignment company. Please note, you must go through the funeral home in order to use an assignment company. This option may not be available in your area, so ask the funeral home for their best solutions. They are knowledgeable and will have helpful suggestions for you.

Take Care of Any Issues Before Death Occurs.

It’s hard to deal with the financial assets of a lost loved one. If there is no clear heir, the courts will likely probate the estate. When an estate is probated, it means that the court system must approve the validity of a last will and testament and confirm the appointment of the executor. This process can sometimes be lengthy and incur additional costs. You will make it much easier for your heirs to inherit your assets according to your wishes if you create a will and update the beneficiary information on your policies regularly.

Preplan Your Funeral.

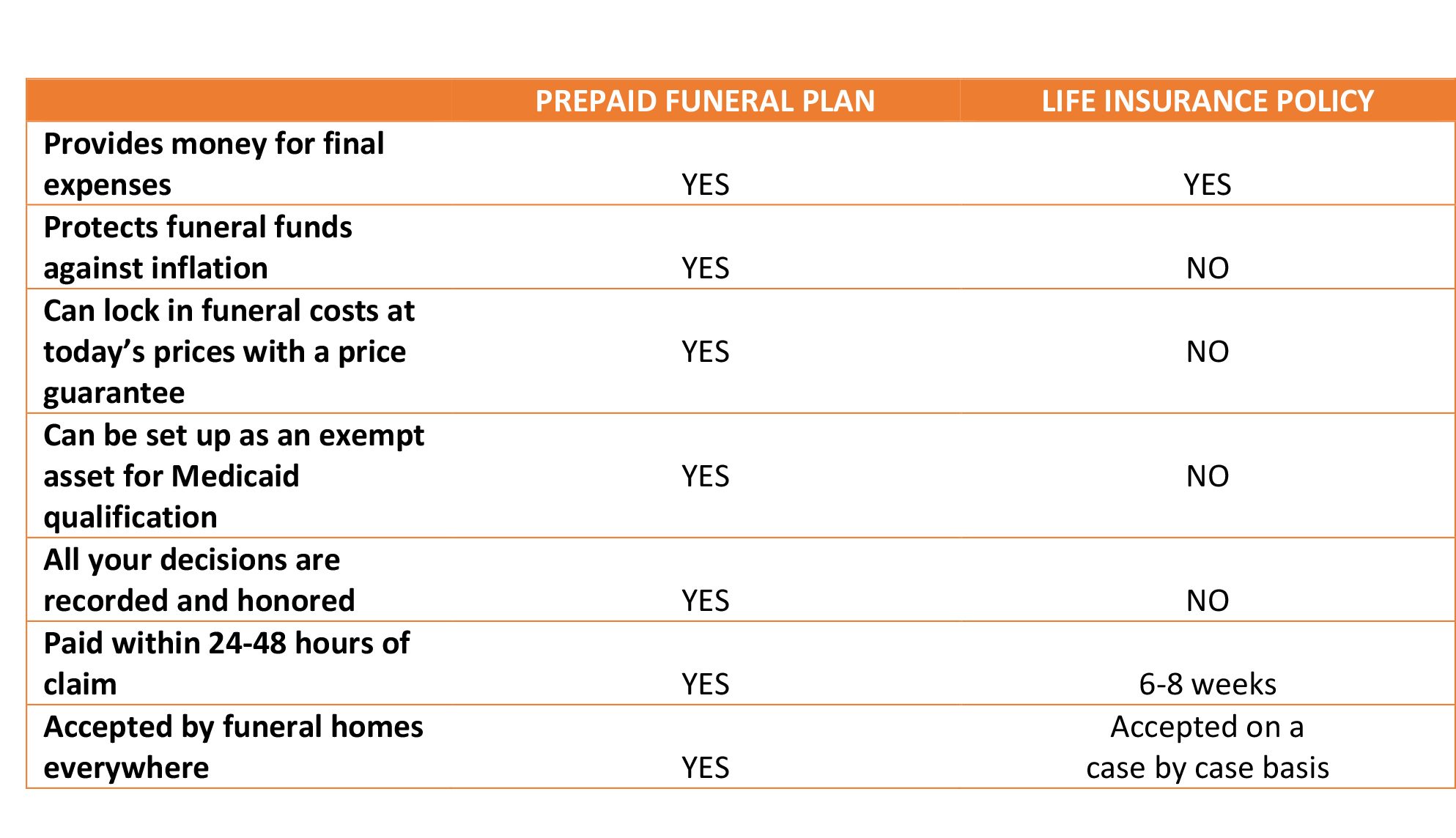

Another way you can help your loved ones is by planning the details of your funeral in advance. This actually helps your family save money because they know your wishes. When family members are grieving, it can be hard for them to make decisions. Sometimes there is a tendency to overspend because people want “only the best” for Mom or Dad. But buying with this mentality leaves less money in the proverbial pot. Will there be enough for living expenses, debt repayment, and maybe even college for the kids? A prepaid funeral plan offers several surprising benefits above and beyond what a simple life insurance policy can do. See the chart below for a few of the benefits of a prepaid funeral plan.

Though it is sometimes a challenge, the funeral home will work with families to discover solutions for funeral payment. Sometimes a death comes quickly and unexpectedly, and people are not always prepared for such a great expense. Determine your plan before tragedy strikes. By doing so, you can relieve your loved ones of money worries on one of the worst days of their lives.