When you lose someone dear to you, grief is a completely normal response. Everybody experiences it. The fact that you are going through feelings of grief means that you had…

The sound of Martha’s voice on the other end of the telephone always brought a smile to Brother Jim’s face. She was not only one of the oldest members of…

Many families plan to pay for a funeral with life insurance benefits. Sounds like a simple plan, doesn’t it? The truth is, there can be many unexpected complications with life…

Also, if you are already comfortable with professional counseling, you might consider speaking with a grief counselor or therapist soon after your loss. There’s no need to wait until you are experiencing complicated grief to see someone. You can speak to a professional at any time during your grief journey, and if you do it sooner rather than later, you may prevent complicated grief entirely.

The sound of Martha’s voice on the other end of the telephone always brought a smile to Brother Jim’s face. She was not only one of the oldest members of the congregation, but one of the most faithful. Aunt Martie, as all the children called her, just seemed to ooze faith, hope and love wherever she went.

This time, however, there seemed to be an unusual tone to her words.

“Preacher, could you stop by this afternoon? I need to talk with you.”

“Of course. I’ll be there around three. Is that okay?”

As they sat facing each other in the quiet of her small living room, Jim learned the reason for what he sensed in her voice. Martha told him that her doctor had just discovered a previously undetected tumor.

“He says I probably have six months to live.” Martha’s words were certainly serious, yet there was a definite calm about her.

“I’m so sorry to…” but before Jim could finish, Martha interrupted.

“Don’t be. The Lord has been good. I have lived a long life. I’m ready to go. You know that.”

“I know,” Jim whispered with a reassuring nod.

“But I do want to talk with you about my funeral. I have been thinking about it, and there are things that I want.”

The two talked quietly for a long time. They talked about Martha’s favorite hymns, the passages of Scripture that had meant so much to her through the years, and the many memories they shared from the five years Jim had been with Central Church.

When it seemed that they had covered just about everything, Aunt Martie paused, looked up at Jim with a twinkle in her eye, and then added, “One more thing, Preacher. When they bury me, I want my old Bible in one hand and a fork in the other.”

“A fork?” Jim was sure he had heard everything, but this caught him by surprise.

“Why do you want to be buried with a fork?”

“I have been thinking about all of the church dinners and banquets that I attended through the years,” she explained. “I couldn’t begin to count them all. But one thing sticks in my mind.

“At those really nice get-togethers, when the meal was almost finished, a server or maybe the hostess would come by to collect the dirty dishes. I can hear the words now. Sometimes, at the best ones, somebody would lean over my shoulder and whisper, ‘You can keep your fork.’

“And do you know what that meant? Dessert was coming!

“It didn’t mean a cup of Jell-O or pudding or even a dish of ice cream. You don’t need a fork for that. It meant the good stuff, like chocolate cake or cherry pie! When they told me I could keep my fork, I knew the best was yet to come!

“That’s exactly what I want people to talk about at my funeral. Oh, they can talk about all the good times we had together. That would be nice.

“But when they walk by my casket and look at my pretty blue dress, I want them to turn to one another and say, ‘Why the fork?’

“That’s what I want to say. I want you to tell them that I kept my fork because the best is yet to come.”

From A 3rd Serving of Chicken Soup for the Soul

Reprinted by permission of Health Communications, Inc. Copyright © 1996 Jack Canfield and Mark Victor Hansen. www.hcibooks.com

Many families plan to pay for a funeral with life insurance benefits. Sounds like a simple plan, doesn’t it? The truth is, there can be many unexpected complications with life insurance policies. Let’s talk about it.

If you are thinking about using a life insurance policy to pay for a funeral, it’s important to understand what factors could complicate the process. Here are a few things (though the list is not comprehensive) that could prevent or delay you or your family from accessing life insurance funds in time to pay for a funeral:

Any of these "red flags" could prevent you from using an insurance policy for funeral expenses. But even if the policy is problem free, it may take 6 to 8 weeks to receive payment. In most cases, that’s long after the funeral has taken place.

If you are thinking about using a life insurance policy to pay for funeral expenses, another question to consider is, “Did the policyholder opt for an insured amount that would be enough to cover all end-of-life expenses as well as replace income?” In other words, is there enough money to cover all expenses AND help the surviving family?

Aside from funeral expenses, there will be many things to pay for after a loved one’s passing. Were there any credit card or medical bills, mortgages, or vehicle notes to pay off? Has the family lost a primary income and the life insurance money can help them stay afloat until that income can be replaced?

If these additional expenses weren’t considered when the policy was taken out, the family may have a hard time covering all the potential costs.

Here are a few solutions that may help you avoid future complications with life insurance at the time of death:

If you plan to use life insurance benefits to cover funeral costs, check the policy to make sure it is still valid and update it as your life changes. If you have any questions, an elder law attorney can help you identify any concerns in your policies and assist you in correcting them. Or, if you are already in the midst of planning a funeral for a loved one, the funeral home can help, though the life insurance company will have more specific answers about the policy.

To make it easier to use a life insurance policy for funeral expenses, make sure that the policy is designated as “assignable." This means that you can sign the benefits over to a third party who will file the claim on your behalf (usually the funeral home or an assignment company). The type of policy you signed up for and the life insurance company determine whether a policy is assignable.

Funeral homes generally accept a life insurance policy in lieu of payment for a funeral, though it's best not to assume that they will. Remember, if they do accept a policy as payment, it must be assignable. If the policy is not assignable, it’s unlikely a family can use life insurance to cover funeral costs because it can take 6 to 8 weeks to process a claim. By that time, most funeral services are already complete.

It can be difficult and complicated to deal with a loved one’s financial assets after their passing. If there is no legally stated heir, the courts will likely probate the estate. When an estate is probated, it means that the court system must approve the validity of a last will and testament and confirm the appointment of an executor. This court procedure can sometimes be lengthy and incur additional costs. It’s much easier for heirs to inherit if there’s a legal will and up-to-date beneficiary information on any insurance policies.

Another way you can help your loved ones is by planning the details of your funeral in advance. When family members are grieving, it can be hard to make decisions. Sometimes there is a tendency to overspend because people want “only the best” for Mom or Dad. But if the family knows your specific wishes, they can hone in on those and potentially save hundreds or even thousands of dollars, which means there will be more life insurance funds leftover to pay for other expenses.

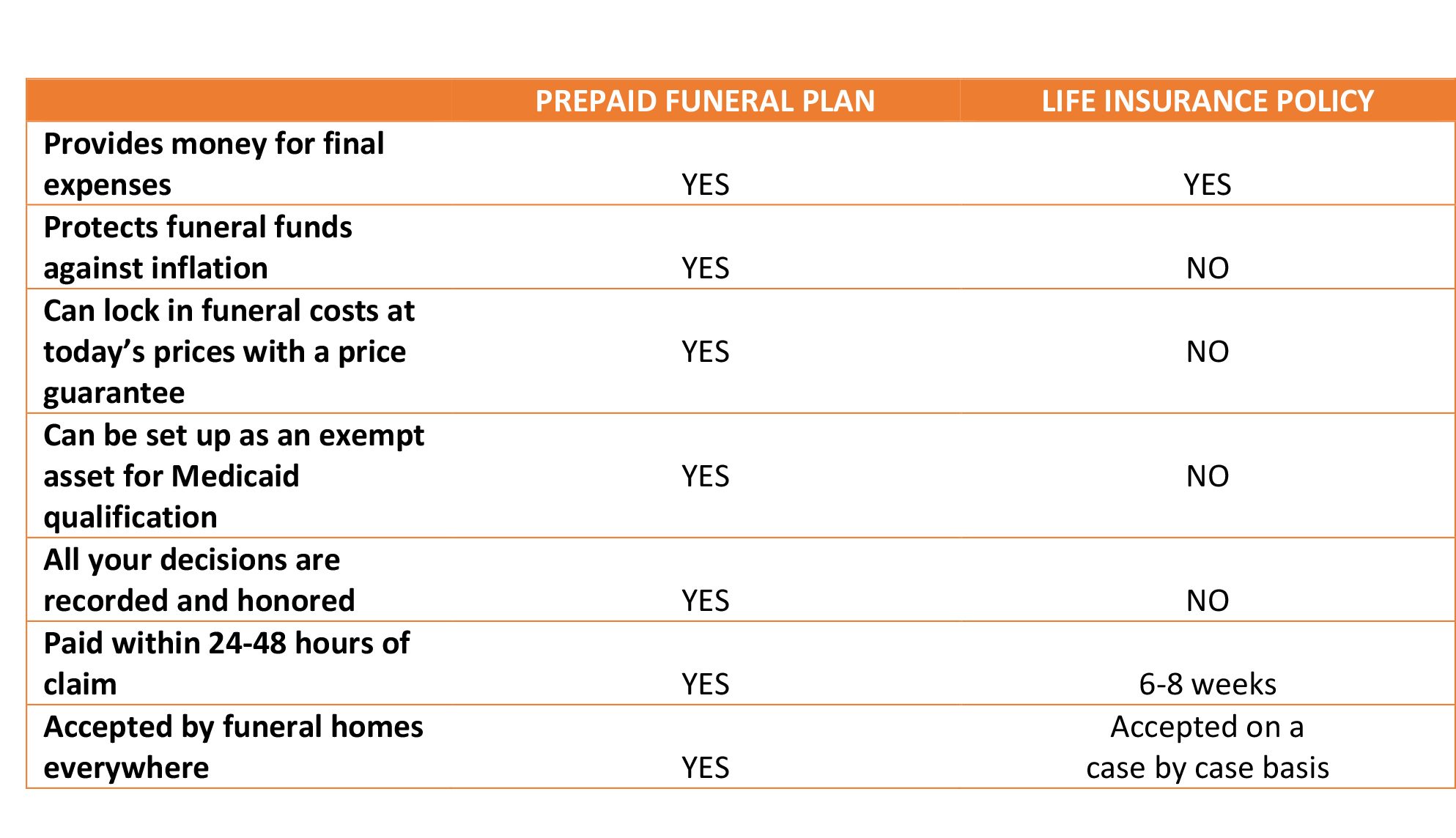

To take it one step further, you can set up a prepaid funeral plan. Essentially, this is a funeral insurance policy, intended to pay for funeral expenses specifically. A funeral insurance policy offers several surprising benefits above and beyond what a life insurance policy can do. Plus, with a funeral insurance policy, you can protect life insurance funds for their true intention - helping the grieving family financially after the loss of a loved one.

To learn more about the benefits of a prepaid funeral plan, check out the chart below.

Some funeral homes offer payment options, but it’s always ideal to determine your plan before tragedy strikes. With a plan in place, you can alleviate the financial stress your loved ones may feel on one of the hardest days of their lives.

Whether you choose to use a life insurance policy or a funeral insurance policy, do a little research. With information in hand, you can do what’s best for your family. Also, remember that a trusted funeral director is a great resource! They’ve seen families use life insurance polices and funeral insurance policies to pay for funeral expenses and can provide expert insight into the pros and possible cons of each.